Pricing Strategies at the time of Platforms

Author: Carlo Nateri

Estimated reading time: 10 min

Tired of reading? Let our lovely AI Amy read it for you:

It’s countless times where we worked with a startup that randomly chose the price of its product. This inevitably leads to a price that is too high or too low compared to the rest of the market, resulting in revenues that don’t fully cover the costs or in customers choosing the option with a better price: in both cases the failure of your entrepreneurial idea.

In a world where Platforms have become so popular among new startups, it’s extremely valuable to know how to price these products in the right way.

That’s why in this article, we’re going to explain to you what a platform is, what the network effect is, some related topics such as the chicken and egg problem and switching costs, and, finally, some price strategies to apply to a platform. Fasten your seatbelts and get ready to stay one step ahead of your competitors.

Two sided market

A platform is a business model that creates value by facilitating interactions and exchanges between two or more parties, usually a buyer and a seller.

In order to make these interactions happen, platforms create an environment in which the network of users and resources is harnessed, large, scalable, and accessible on demand. Platforms create communities and markets with network effects that enable the members to interact and transact.

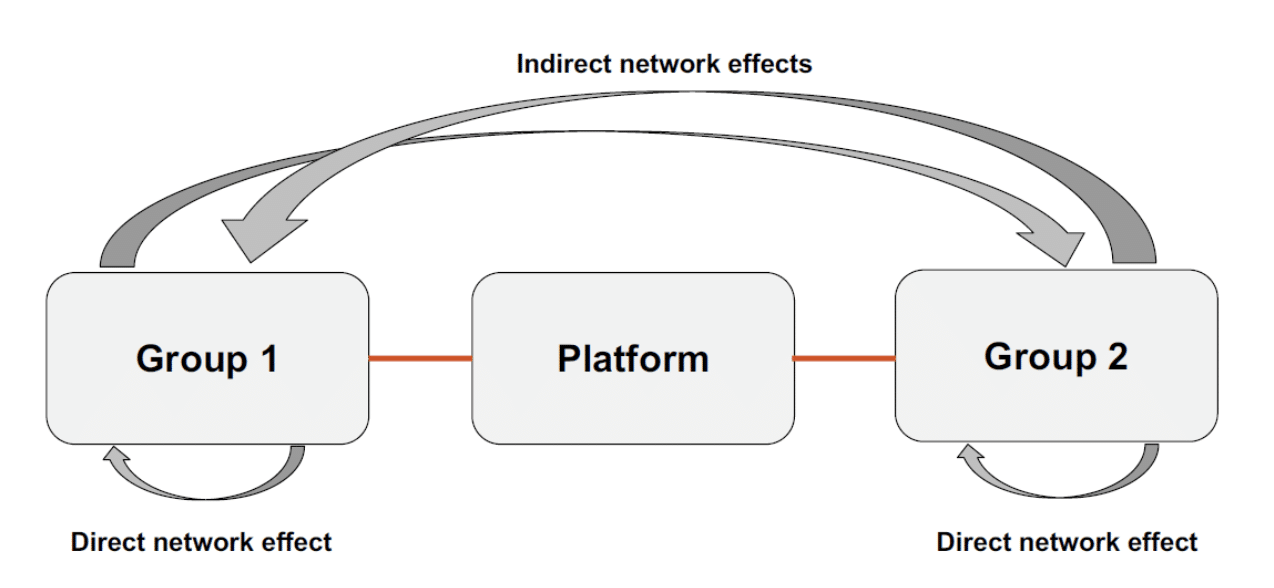

The main components of this two-sided market are:

- Two sides willing to interact (can be consumer on both sides or buyer and seller)

- Existence of network effects (Direct: within sides, Indirect: across sides)

- Specific pricing structure (which depends on indirect network effect and on competition)

Pricing structure: two sides, two prices

As producers and retailers, we fix and sell a product at a price p. Our profit is: revenue – cost → (p x Q) – C

As a platform (specifically in matchmaker), we decide on two prices: p1 for group 1 and p2 for group 2. The number of subscribers are S1 and S2. My profit is (p1 x S1 + p2 x S2 ) − C

We can charge a proportional fee to sellers (f1) and to buyers (f2).

My profit is f1 x (p x Q) + f2 (p xQ) – C

We can charge a proportional fee to sellers (f1) and a fixed fee for buyers (F2).

My profit is: f1 (p x Q) + F2S2 – C

We can also combine a fixed fee and a proportional fee, on each side.

What are the network effects and why are they so important

The strength of network effects impacts the price structure in the two-sided market. We’ll briefly describe what these are and what are the main categories in order for you to better understand their importance.

The Direct network effect happens when each group’s members have preferences regarding the number of users in their own group.

The Indirect network effect happens when members of at least one group have a preference regarding the number of users in the other group.

For example, think about Playstation. We can see it as a platform where the two sides are the users and the game developers.

The direct network effect would then be the fact that the more people play with Playstation, the better it is for them because there’ll be more players also in online gaming.

The indirect network effect is that the more users play with Playstation, the more interesting it becomes for game developers to create games for this platform. And the higher the number of games available, the better it is for the gamers because they have access to a wider gaming experience.

The value of a “network good” depends on the quality of the good itself (inherent value) but also on the size of the network associated with it (network value).

- Inherent value is the one that does not change with the number of users.

- Network value increases or decreases with the number of users.

If the indirect effect of group 1 on group 2 is bigger than the indirect effect of group 2 and group 1, then the platform will charge more to group 2.

What’s tricky about pricing a platform

The most difficult aspect in pricing a platform is the difference between the targeted customers. If you don’t manage to recognise this difference, the ecosystem of the platform will be inefficient, resulting in not attracting new customers or worse, in losing them.

Below, We’ll show you the most common types of clients, what they look for in a platform they want to use and how they usually behave there.

The chicken and egg problem

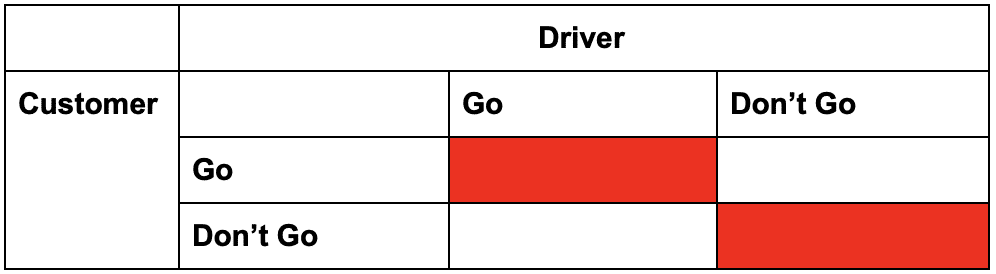

This scenario usually happens in those platforms where there are two sides, two different parties and one of the two joins the platform just because of the presence of the other.

This happened for example with UBER. The two parties are the drivers and the users that need a drive. If there are no users looking for a ride, any driver will join the platform and vice versa.

Why is that?

Let’s go through it.

U2 (go; go) or U2(no go; go) > U2(go; no go) or U2(no go; no go).

It means that we have to find a way to make the Go;Go strategy the dominant one. UBER managed to do so making it as easy as possible for one side to say ‘yes’. Drivers are much more open to trying Uber when all they need to do is accept a phone from Uber and keep it on. It’s simple, and it’s low-risk – there’s plenty of upside if any ride requests come on the app, but there’s no downside at all.

In order to solve this problem, the startup usually has to price 0 or below 0 (loss) in order to attract one side – this side will be called the “loss leader side”.

The maximum price has to be set on the other side to maximize the profit – this side will be then called the “profit making side”.

Switching Costs

“A switching cost results from a consumer’s desire for compatibility between his current

purchase and a previous investment.”

Klemperer 1995

Switching costs can be:

Without switching costs:

With switching costs:

The objective of a company should be to build high switching costs, have high network effects and manage to lock-in the customer.

Pricing Strategies you can apply

We’ll move now to show you the hot part of this article. Which are the most common ways to actually pricing your platform and which are the pros and cons of each of these methods.

Here you go:

1) FLAT-RATE PRICING

The focal point is to offer a single product, a single set of features, and a single price.

Pros:

Easier to sell. Offering a single product at a single price makes it possible to focus on selling a single, clearly-defined offer.

Easier to communicate. Platforms pricing models can get complicated.

Cons:

Difficult to extract value from different users. If you’re targeting SMBs, and use an SMB-friendly pricing strategy, you’ll miss out on revenue if any Enterprise companies decide to adopt your tool.

One-shot at securing customers. There’s no nuance or flex in flat-rate pricing: either the customer wants the package, or they don’t – and there’s little to do to sway them.

2) USAGE-BASED PRICING

This type of pricing strategy directly relates the cost of the platform to its usage: if you use more of the service, the bill goes up; if you use less, the bill decreases.

Pros:

Price scales alongside usage.

Reduces barriers to use. There are no big up-front costs with usage-based pricing, and even the smallest startups can get started with your product.

Accounts for “heavy user costs”. With fixed-price packages, there’s always the risk of “heavy” users taking up a disproportionate amount of the resource, without compensating for it with increased spend.

Cons:

Harder to predict revenue. Usage-based pricing typically means that billing amounts will vary, making it much harder to forecast revenue.

Harder to predict customer costs. The same problem applies to customers: those with volatile usage may see wild (and potentially unexpected) fluctuations in their monthly bill.

3) TIERED PRICING STRATEGY

Tiered pricing allows companies to offer multiple “packages”, with different combinations of features offered at different price points.

Pros:

Appeal to multiple personas. With a single package, you have one shot with your target customer; with tiered pricing, you can tailor packages to multiple customer personas.

Take all the money on the table. By appealing to multiple personas, you can maximise the revenue generated from different types of customer.

Clear upselling route. When your customer needs to upgrade their current package, there’s a direct route to the next price point.

Cons:

Potentially confusing. Choices can easily become overwhelming, and having to decide between 15 price tiers is a rapid route to an abandoned sale.

Appeals to too many people. It’s tempting to create a wide range of packages to appeal to every possible need – but you can’t be everything to everyone.

“Heavy user risk”. If top tier users regularly exceed their allocated service usage, you have no recourse for collecting extra revenue to compensate.

4) FREEMIUM BUSINESS MODEL

Freemium pricing: offering a free-to-use product, supplemented by additional paid packages.

The freemium business model is typically used as part of a tiered pricing strategy: the paid packages are supplemented with a free, entry-level tier.

That tier is then limited across certain aspects to encourage users to upgrade at a certain level of usage, typically features (if you want more features), capacity (if you need more capacity) or use (you can use the free package internally but not externally).

Pros:

It’s a foot in the door. Initial adoption is one of the biggest challenges faced by platforms businesses, and the freemium model makes it easy for customers to get started with your product.

Viral potential. With low barriers to use come significant viral potential.

Cons:

Freemium is a revenue killer. Free users don’t generate any revenue for the company. The paying users need to cover all the expenses.

It’s easier to churn on a free package. While free-to-use versions make spreading easier, it also makes it easier for users to switch.

It can devalue your core service. If the product solves a problem for free, the users may resent having to eventually pay for the service.

To wrap up

Our trip through the pricing of platforms has come to an end. We’ve seen the reasons why it’s so hard to price a platform, but also why the prices have to be chosen carefully in these days where the competition is tough.

Missing to understand the strengths and the weaknesses of your product, what the network effects are, what is the chicken and egg problem, what are the switching costs and what is the most suited pricing strategy for your platform, will inevitably lead to stay behind your competitors or worse.

In a world where every day new platforms are born, we hope that this article has given you a better insight into this topic and provided you with some competitive advantage.

Reference

1. https://www.applicoinc.com/blog/what-is-a-platform-business-model/

2. https://medium.com/ondemand/how-uber-solved-its-chicken-and-egg-problem-and-you-can-too-fab